We’ll Help You Find the Right Secured Loan

Fluent Money is a UK-based secured loans broker. We search an extensive panel of lenders to find loan options tailored to your needs.

Why People Choose Fluent Money

Low Interest Rates

Rates for loans secured on property can be lower because there’s less risk for lenders, with your home as security.

Borrow Larger Sums of Money

Lenders are often more willing to lend larger sums (£10,000 – £500,000) because your property secures the loan.

Lower Monthly Repayments

Most secured loans can be repaid over the long term (3 to 30 years). This often means lower monthly repayments, making them more manageable. But remember: spreading payments out can increase the total cost.

Extensive Panel of Lenders

It allows us to provide you with options tailored to your needs.

Reasons to Get a Secured Loan

Debt Consolidation

Putting all debts in one place as a single monthly payment can decrease the stress of managing different interest rates, terms and payment dates throughout the month.

Home Improvements

If you’re planning your dream kitchen, making your home more energy efficient, or adding that much-needed extension, a secured loan could be the right option for you.

Second Home

The equity in your property can be used to purchase a second home. Speak to our advisors to look at your options.

Anything Else

You may want to consider taking out a secured loan if you are looking for a large sum of money and want to pay it back over a longer term.

How it Works

Fill Out Our Form

One of our certified advisors will call you

Tell Us About Your Needs

Once we understand your circumstances, we will search our panel to find your best options.

We Will Provide You With Options

When we find the right match, we’ll explain your options clearly.

Loan Application Online

Our secured loan application process in done fully online. We’ll be with you every step, all the way to approval.

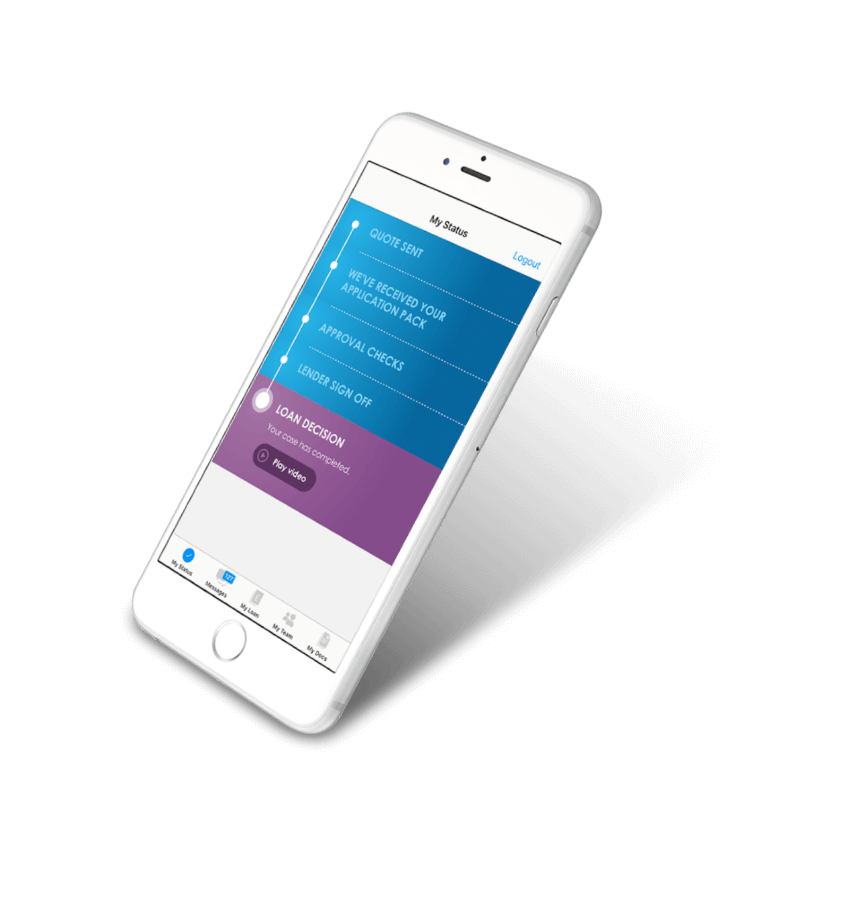

Stay in the Loop 24/7 with MyFluent App

View the progress of the loan application in real time and easily communicate with your dedicated Case Manager.

Ready to Apply?

Secured loans (also called “homeowner loans” or “second charge mortgages”) can be a good option if you need to borrow a larger sum while keeping your interest rates and monthly repayments lower.

Speak to one of our friendly advisers today, and they’ll be able to help with any questions you have.

FAQs

A secured loan is taken out against property you own. This could be your home, and this is why it’s also known as “homeowner loan” or “second charge mortgage”.

If you’re looking to make home improvements, consolidate some debt, or fund a big purchase, a secured homeowner loan is a great option to consider. Interest rates are usually lower than an unsecured personal loan as there is more security for the lender.

As with most loans, you’ll have to pay your secured loan back in monthly installments. You will also pay interest on your loan. Depending on the loan you have, this can be a fixed rate of interest, or it could be variable. The interest will be calculated by the amount you have left to pay. We’d recommend setting up a direct debit or standing order to pay the monthly loan repayments, particularly as your home is used to secure the loan.

A secured loan is also known as a second charge mortgage. This means you need to be a homeowner with an existing mortgage to take out a secured loan. This is because your house will be used as security for your lender.

At Fluent Money, we’re committed to helping you lend money responsibly. We will work to try and find the best solution for you. With a secured loan, because you’ll be using your house as security, lenders are more open to lending to those with poor credit ratings, CCJs or mortgage arrears.

Once you have the loan, regular repayments will help boost your future credit score too. If you have a lower credit score, it might be that your interest rates are higher than someone with a higher credit score.

With all the above considered you must remember that you need to keep up the monthly repayments with a secured loan or your home may be repossessed.

A secured loan is one option to help consolidate your debt, as you will often be paying less interest on one large loan compared to lots of small ones (or lots of credit cards). But it’s important to understand the risks too. By consolidating unsecured debts you may be extending their term, and increasing the overall amount you will repay. If you want to use a secured loan to consolidate your debts, it’s worth speaking to an adviser at Fluent Money, as you need to make sure the loan you take out is one you will be able to afford to pay back. If you can’t keep up with repayments, you might end up losing your home.

At Fluent Money, we have a huge range of flexible options to suit your needs. We can offer secured loans from 3 – 30 years.

A secured loan is a loan secured on property you own – usually your home. The idea here is that the borrower has an incentive to pay back the loan on time. This provides the lender with security, and interest rates can be lower.

An unsecured loan, on the other hand, is not secured against anything. Interest rates can be higher because there is less security for the lender compared to a secured loan.

APRC stands for Annual Percentage Rate of Charge. It shows the total cost of borrowing over the full term of a secured loan or mortgage, including:

Interest (even if the rate changes over time)

Fees (like arrangement or broker fees)

Any known rate switches (e.g. from fixed to variable)

It’s designed to help you compare long-term deals more easily, especially when rates might change during your loan term.

Why does APRC matter?

If your deal starts with a fixed rate and then switches to a variable one, the APRC gives you a clearer idea of what the loan could cost overall — assuming you stick with it for the full term.

Just like with APR, the lower the APRC, the less you’re likely to repay across the life of the loan.

A credit score is a number that tracks how you spend money to show lenders if you’re a risk to lend to. It’s a measurement that looks at your past repayment history and any money you already owe.

There are a few simple steps you can take to improve your credit score easily, such as registering to be on the electoral register, avoiding taking cash out from a credit card, and cancelling any credit cards you don’t use.

Yes, a secured loan (or second charge) needs to be repaid in full when remortgaging. This means that the customer will either need to pay it off with their own funds or borrow more money (on top of what they need to repay the current lender) to cover the second charge.